Why Estate Planning Is a Radical Act of Love in the Digital Age

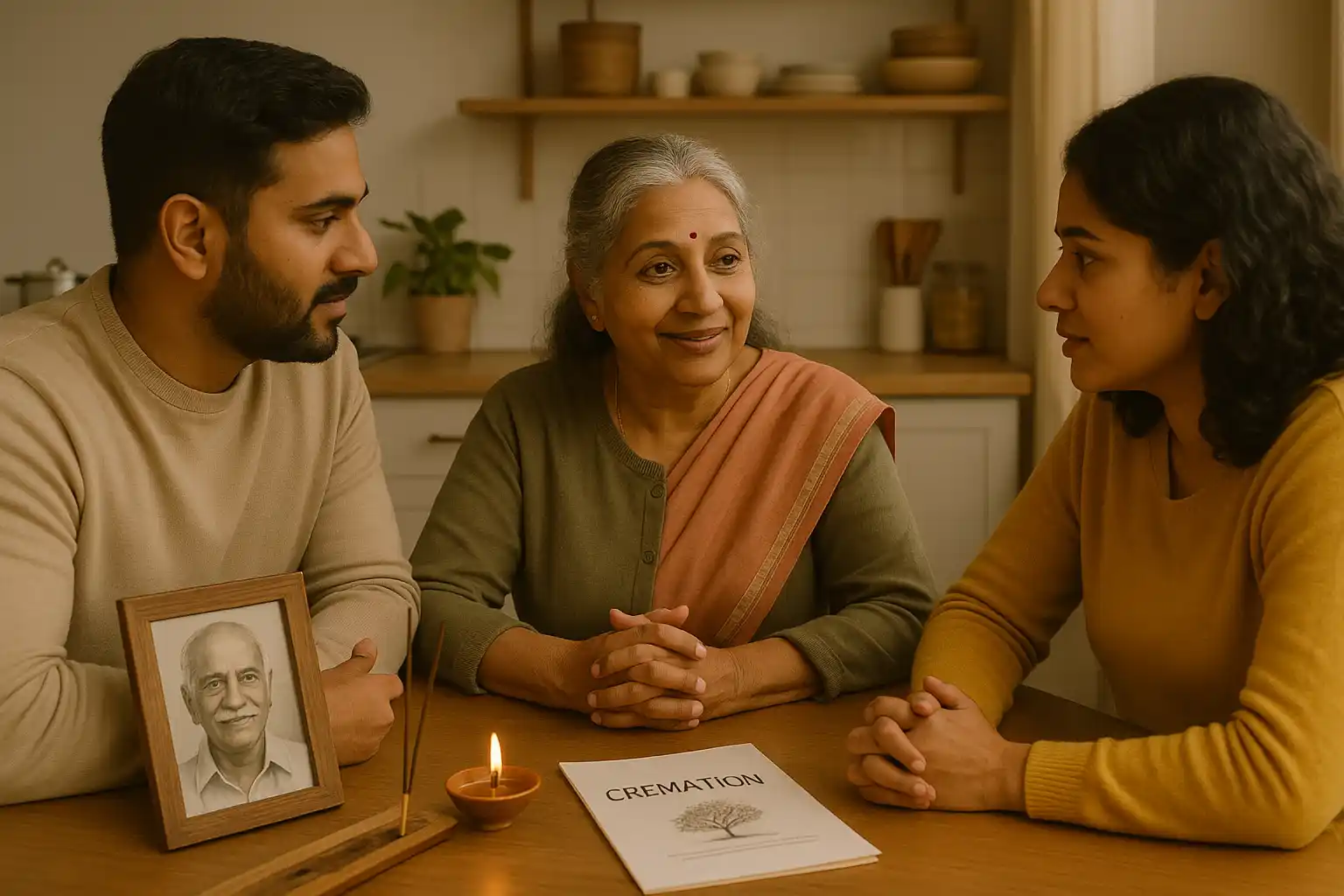

When most people hear the words “estate planning,” their eyes glaze over. It sounds like something reserved for the ultra-wealthy, a task better suited for an expensive lawyer’s office than your laptop. But what if we told you that estate planning isn't about money—it's about meaning? It's a radical act of love for your family, your values, and your legacy.

About This Blog

When most people hear the words “estate planning,” their eyes glaze over. It sounds like something reserved for the ultra-wealthy, a task better suited for an expensive lawyer’s office than your laptop. But what if we told you that estate planning isn't about money—it's about meaning? It's a radical act of love for your family, your values, and your legacy.

We’re living longer, moving more, blending families, and accumulating assets in increasingly digital ways. And yet, the tools and conversations surrounding death, dying, and the practicalities of life’s end have remained stuck in the past—until now.

The Emotional Minefield of Planning for Death

Despite knowing it’s inevitable, most people avoid planning for death. The reasons aren’t just logistical—they're deeply emotional. Thinking about mortality stirs up fear, grief, and even guilt. Add to that the complexity and cost of traditional estate planning, and it's no wonder people delay it for years, sometimes until it’s too late.

The truth? Not having a plan creates a much heavier burden for the loved ones you leave behind. Without proper documentation, your family could face expensive, emotionally draining probate processes—often in the middle of mourning. In some states, this legal limbo can last years and cost tens of thousands in court fees.

But as morbid as it might sound, facing mortality is also an invitation to live with more intention. Just like budgeting forces you to confront how you spend money, estate planning makes you think about how you spend your life—and what (and who) really matters.

A Shift from Legalese to Empowerment

Fortunately, estate planning is undergoing a transformation.

New digital-first companies are reframing it not as a legal chore, but as an accessible and even empowering experience. With platforms like Trust & Will , people can build legally valid wills and trusts online in under an hour. No high hourly attorney fees. No faxing documents. No waiting in sterile law offices.

But the innovation doesn’t stop at making it digital. The best platforms are embedding education, empathy, and user-friendly design into every step. Think TurboTax, but for your final wishes. Whether you’re a 30-something new parent or a 60-year-old retiree, these tools make it easy to understand the difference between a will and a trust, how probate works, and what your loved ones will actually need from you when you're gone.

And perhaps most importantly—they make it doable. Because when something feels manageable, you’re more likely to actually do it.

Tackling Procrastination with Purpose

Let’s be real: procrastination is the biggest barrier to estate planning. Even when the tools are simple and the price is right, it’s easy to push it off until "later." But later isn’t a guarantee.

That’s why forward-thinking platforms are investing heavily in user education. Through searchable articles, checklists, webinars, and quizzes, they’re making estate planning feel less like a black box and more like a to-do list you can actually finish. Some even use AI to give your plan a "strength score," like a credit score for your legacy—so you know exactly where you stand and what steps to take next.

These features don’t just educate—they motivate. When you see that your plan is only 40% complete, it’s a nudge. When you’re reminded that your kids aren’t yet listed as beneficiaries, it’s a push toward action. And when you realize that planning now could spare your family months—or years—of stress, it becomes a no-brainer.

Tech Is Closing the Compassion Gap

One of the more surprising lessons in the digital death space? Technology can actually increase empathy.

That might sound counterintuitive. After all, estate planning is deeply human, deeply emotional work. But it turns out, software can take the cold bureaucracy out of the equation and leave more room for compassion.

Instead of overworked attorneys or aloof clerks, today’s users get warm, responsive support teams trained to handle emotional conversations with care. They get reminder emails that are kind, not pushy. And they’re invited to write final messages to loved ones—not just fill out forms.

Some platforms are even working with legislators to make electronic wills and digital notarizations legal in all 50 states. Why? Because nobody should lose out on protecting their family just because they couldn’t get a notary to a hospital bed in time.

Estate Planning Is Selfless, Not Self-Centered

At its core, estate planning isn’t really about you. You’ll be gone. It’s about everyone you love, and whether they’ll be left with clarity or chaos.

It’s about your partner knowing your wishes without second-guessing. It’s about your children having a smoother transition, instead of battling through red tape and court fees. It’s about making your death less of a logistical nightmare—and more of a peaceful goodbye.

You don’t need to be rich. You don’t need to be old. You just need to care.

Start with the Small Steps

If you’re not sure where to begin, start small:

Take a free estate planning quiz online to see whether a will or a trust fits your needs.

Gather a list of your major assets—your home, bank accounts, retirement funds.

Have a conversation with your partner or closest friend about who you’d trust to handle your affairs.

Decide what you want your legacy to be—not just your money, but your values and voice.

Estate planning isn’t something you "get around to." It’s something you choose. And that choice can make all the difference.

Ready to take the first step? Dive deeper into the conversation and hear more wisdom from Cody Barbo by watching the full episode of The Digital Legacy Podcast on YouTube. You’ll leave informed, inspired—and maybe even ready to tackle your own legacy.

If something happened to you, would the people in your life know what to do? Don't leave your loved ones in the dark. Start developing your end-of-life and digital legacy plan. Download the My Final Playbook App on the App Store or Google Play or visit us online at Final-Playbook.Passion.io to get started. With My Final Playbook, you'll be able to start and learn how to organize your legal, financial, physical, and digital assets today. Until then, keep your password safe and your playbook up to date.

Related Blog

Duis mi velit, auctor vitae leo a, luctus congue dolor. Nullam at velit quis tortor malesuada ultrices vitae vitae lacus. Curabitur tortor purus, tempor in dignissim eget, convallis in lorem.

Comments